Metro Denver's Housing Update - August 2023

Residential Housing Market Trends for the 11-County Denver Metro Area.

In an examination of the statistical data, the housing trends for the month of August exhibit a mixed picture, featuring both encouraging improvements and certain areas of concern. While local housing prices have displayed signs of stabilization and growth, a pivotal question arises: Is this positive trend sustainable?

The equilibrium between affordability and unaffordability in the real estate market has been consistently tilting towards the latter, presenting a growing challenge for prospective buyers. Concurrently, the cost of borrowing funds has exhibited a steady ascent, with the 30-year fixed mortgage rate standing at approximately 7.2 percent, representing a notable increase of 1.5 percent compared to the same period last year.

To provide a tangible perspective, consider the scenario in August 2020, when the median home price amounted to $507,750, accompanied by a 2.9 percent interest rate. At that time, the principal and interest payments amounted to $1,697 per month. Fast-forward to the present day, the median home price has surged to $650,000, coupled with a 7.2 percent interest rate, resulting in a monthly payment of $3,523. Consequently, the monthly financial commitment for the median-priced home has surged by a staggering 107.6 percent since 2020, and this analysis does not even encompass the effects of escalating tax and insurance expenses.

When assessing price trends, the average closed price in August exhibited a marginal decline of 0.25 percent compared to the previous month, a customary seasonal occurrence within our housing market, where prices tend to recede in the latter half of the year. Encouragingly, the year-over-year comparison for August demonstrates a notable increase of 4.88 percent, which is promising for home sellers.

While the national media reports low inventory and its implications on pricing, our local inventory situation offers a distinctive perspective. At the conclusion of August, the 11-county metro area displayed 6,858 active listings, representing a decrease of 1.17 percent compared to the previous year. This inventory flux is fundamentally influenced by the dynamic interplay between new listings and those transitioning to a pending status.

August witnessed 4,863 new listings entering the market, signifying a 6.16 percent reduction compared to the corresponding period in 2022. It is noteworthy that this single-digit decline presents a favorable development when contrasted with year-to-date figures, which indicate a 21.44 percent reduction in new listings compared to the same period in the previous year.

In terms of pending sales, August exhibited a modest and unexpected increase of 0.76 percent relative to July. This uptick may be attributed to the conclusion of the summer season as families settle into their back-to-school routines. However, a less optimistic observation is that August's total of 3,845 pending sales falls short of the 4,466 recorded during the same month in the previous year, reflecting a notable decrease of 13.91 percent.

Turning our attention to the local rental market, the average rent for a two-bedroom property stands at $2,081, marking a decline of 2.4 percent in comparison to August 2022. While rental prices have been exhibiting a downward trend over recent years, the availability of rental listings has been on the rise. In August, there were 9.0 percent more rental options compared to the same period in the preceding year, possibly attributed to renters seeking additional roommates to offset costs.

The trajectory of the real estate market's future remains uncertain. The Federal Reserve's projection of a soft landing, suggesting the absence of a recession, is met with skepticism, as previous predictions by the Fed have not materialized as forecasted. Some experts are predicting a recession, possibly commencing in early 2024, though the future landscape remains uncertain.

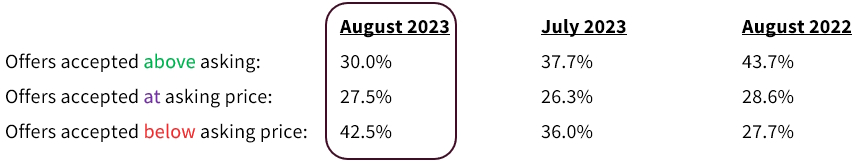

Lastly, it is imperative to highlight a significant shift in market dynamics. In August, 30.0 percent of sellers accepted offers above their asking prices, marking a substantial decline from July's figure of 37.7 percent and a considerable drop from the 43.7 percent recorded in August of the previous year. To provide additional context, during one of the peak months, May 2021, a striking 72.2 percent of sellers accepted offers above their asking prices. This shift underscores the departure from the previously robust seller's market, and if this trend persists, it is likely to exert a discernible downward pressure on housing prices in the near future.

Source of data: REColorado.com